|

|

|

Main

Page by Topic |

||

|

C.

Statistics |

||

Historic

VaR

Overview

This page

covers a more details about Historic VaR.

For a general

VaR ‘Value-at-Risk’ introduction, click on this link:

Outline

2) Example

3) Ways to Calculate ‘Price Changes’

4) Considerations for CTRM Design

Historic VaR

is one of the methodologies for calculating a VaR value. A VaR value is one measure of market risk,

which we’ll define as ‘the threshold where you are expected to lose more than

that threshold just 5% of the time’.

Historic VaR

uses actual prices, i.e., commodity prices in this case. E.g., prices over a certain time frame

leading up to today. This makes Historic

VaR relatively easy to add to a CTRM system since we can assume historic settle

(‘closing’) prices would already be loaded into the system, as they are needed

to calculate index based (‘floating’) payments.

2) Example

For our

example, we’ll assume one trade of long 1000 BBL of Crude Oil. The current market price, as of 06-Jun-2019

is $52.13, which gives up a value of 1000 BBL * $52.13 = $52,130.

We’ll use

approximately 2 months of prices in our example. We’ll use 41 days of

prices. This is business days, so no

weekends or holidays.

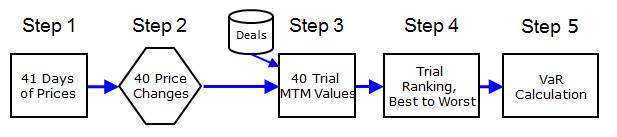

And we’ll

follow these steps:

2.1) Step 1

Step 1 is to

gather the last 41 days of prices, which includes today, assumed to be 06-Jun-2019. Note that the prices are example and not real

settle prices for Crude Oil. We show an

abbreviated set of prices below, with the middle section cut out, just to make

this blog post smaller.

We count today

as ‘1’ and then count back to 41 days.

|

Day# |

Date |

Price |

|

41 |

11-Apr-2019 |

52.13 |

|

40 |

12-Apr-2019 |

52.41 |

|

39 |

15-Apr-2019 |

52.57 |

|

38 |

16-Apr-2019 |

52.75 |

|

... |

... |

... |

|

4 |

3-Jun-2019 |

52.71 |

|

3 |

4-Jun-2019 |

52.43 |

|

2 |

5-Jun-2019 |

51.90 |

|

1 |

6-Jun-2019 |

52.13 |

2.2) Step 2

For Step 2, we

calculate the price changes.

Note that we

wind up with just 40 price changes, i.e., one less than the number of

days. We used just the simple price

change of one day minus the prior day.

|

Day # |

Date |

Price |

Price Change |

|

41 |

11-Apr-2019 |

52.13 |

N/A |

|

40 |

12-Apr-2019 |

52.41 |

0.28 |

|

39 |

15-Apr-2019 |

52.57 |

0.16 |

|

38 |

16-Apr-2019 |

52.75 |

0.18 |

|

... |

... |

... |

... |

|

4 |

3-Jun-2019 |

52.71 |

0.05 |

|

3 |

4-Jun-2019 |

52.43 |

-0.28 |

|

2 |

5-Jun-2019 |

51.90 |

-0.53 |

|

1 |

6-Jun-2019 |

52.13 |

0.23 |

We can take

these price changes and rank them from worst to best. As shown in the table below.

For ‘Ranked

#’, that is based on a numbering based on the price change ranking. We kept the Day # and Date from the prior

table for a comparison, though we don’t really need those values in the

calculations going forward. Same for

showing ‘Price’, i.e., we are showing it for clarity, but we no longer need the

price. All we need is the price change.

For 95%

confidence level VaR, we want the 5% worst value, which is the row at rank 38,

which is -0.24.

So just from

this, we can say that ‘worst case’ (defined at a 5% threshold), the market

might go down -$0.24, so our 1000 BBL could go down $0.24 and so we could lose

$240. However, we’ll continue with the

other steps for clarity and, especially, because in a real situation, we won’t

just have one deal, so it will require more effort than we can just figure out

with intuition.

|

Ranked # |

Day # |

Date |

Price |

Price Change |

|

40 |

2 |

5-Jun-2019 |

51.90 |

-0.53 |

|

39 |

3 |

4-Jun-2019 |

52.43 |

-0.28 |

|

38 |

16 |

16-May-2019 |

52.93 |

-0.24 |

|

37 |

7 |

29-May-2019 |

52.42 |

-0.24 |

|

... |

... |

... |

... |

... |

|

4 |

27 |

1-May-2019 |

52.87 |

0.23 |

|

3 |

26 |

2-May-2019 |

53.1 |

0.23 |

|

2 |

1 |

6-Jun-2019 |

52.13 |

0.23 |

|

1 |

40 |

12-Apr-2019 |

52.41 |

0.28 |

2.3) Step 3

Calculate the

40 trial MTMs

For this one

deal, the new MTMs are just quantity * price.

The ‘price’ is

the ‘Trial Price’, which is the current market price and then add in the set of 40 price changes.

Looks like

this. Note that we aren’t showing these

rows ranked from best to worst. We went

back to showing rows sorted by date.

|

Day # |

Date |

Starting Price |

Price Change |

Trial Price |

Volume |

Trial MTM |

|

40 |

12-Apr-2019 |

52.13 |

0.28 |

52.41 |

1000 |

$ 52,410 |

|

39 |

15-Apr-2019 |

52.13 |

0.16 |

52.29 |

1000 |

$ 52,290 |

|

38 |

16-Apr-2019 |

52.13 |

0.18 |

52.31 |

1000 |

$ 52,310 |

|

37 |

17-Apr-2019 |

52.13 |

-0.11 |

52.02 |

1000 |

$ 52,020 |

|

... |

... |

... |

... |

... |

... |

... |

|

4 |

3-Jun-2019 |

52.13 |

0.05 |

52.18 |

1000 |

$ 52,180 |

|

3 |

4-Jun-2019 |

52.13 |

-0.28 |

51.85 |

1000 |

$ 51,850 |

|

2 |

5-Jun-2019 |

52.13 |

-0.53 |

51.60 |

1000 |

$ 51,600 |

|

1 |

6-Jun-2019 |

52.13 |

0.23 |

52.36 |

1000 |

$ 52,360 |

2.4) Step 4

Now we’ll rank

the trials by MTM, best to worst.

For this

example with just one deal, this is the same as just looking at the price

changes on their own. However, for more

complicated examples, especially with options (option trades, e.g., calls/puts), you need to look at the MTM values as they won’t directly

correlate with price changes.

|

Ranked # |

Day # |

Date |

Trial MTM |

|

40 |

2 |

5-Jun-2019 |

$ 51,600 |

|

39 |

3 |

4-Jun-2019 |

$ 51,850 |

|

38 |

16 |

16-May-2019 |

$ 51,890 |

|

37 |

7 |

29-May-2019 |

$ 51,890 |

|

... |

... |

... |

... |

|

4 |

27 |

1-May-2019 |

$ 52,360 |

|

3 |

26 |

2-May-2019 |

$ 52,360 |

|

2 |

1 |

6-Jun-2019 |

$ 52,360 |

|

1 |

40 |

12-Apr-2019 |

$ 52,410 |

2.5) Step 5

To calculate

VaR at the 95% level, we’ll take the unchanged MTM, which was $52,130 and

compare it to the MTM from the ‘worst cast’ trial MTM at the 95% level (or 5%

level going the other way), which is shown above at ‘Ranked #’ 38, or $51,890.

This given a

Historic VaR value of $240 = $52,130 - $51,890.

Some readers

may be screaming (internally) about the example using price changes based on

subtracting two days of prices and may be thinking, wouldn’t percentage changes

be better?

Indeed they

would be in many cases.

Another method

is to use the log of the percent change, i.e. the natural log. Excel has this formula as ‘ln’. There are good theoretical reasons to use

natural log and it relates to a modelling assumption that commodity price

*changes* (i.e., not prices) are lognormally distributed.

Here is the

original price changes table with extra columns for price change as a percent

and the log of the price change as a percent.

We show ‘price

change as a percent’ as 1.0053712, i.e., the new price is 100.53712% of the

prior percent. This is called the ‘one plus’ format for the price change, i.e., instead of just

saying ‘up 0.53712%’ (because we add one).

For taking the log, you need to take the log of the ‘one plus’ return.

|

Day# |

Date |

Price |

Price Change |

Price Change % |

Price Change ln

% |

|

41 |

11-Apr-2019 |

52.1 |

|

|

|

|

40 |

12-Apr-2019 |

52.4 |

0.28 |

1.0053712 |

0.0053568 |

|

39 |

15-Apr-2019 |

52.6 |

0.16 |

1.0030529 |

0.0030482 |

|

38 |

16-Apr-2019 |

52.8 |

0.18 |

1.0034240 |

0.0034182 |

|

... |

... |

... |

... |

... |

... |

|

4 |

3-Jun-2019 |

52.7 |

0.05 |

1.0009495 |

0.0009490 |

|

3 |

4-Jun-2019 |

52.4 |

-0.28 |

0.9946879 |

-0.0053262 |

|

2 |

5-Jun-2019 |

51.90 |

-0.53 |

0.9898913 |

-0.0101602 |

|

1 |

6-Jun-2019 |

52.1 |

0.23 |

1.0044316 |

0.0044218 |

When

calculating the trial MTM values, i.e., ‘shocking’ the prices based on the

price changes, you need to be consistent.

So, for example, if you calculated the price change as a percent, you

need to ‘shock’ the prices up by a percent, and if you calculated the price

changes as a subtraction from the prior day, you need to add/subtract the price

changes to the current prices to calculate your trial MTM values.

4) Considerations

for CTRM Design

The ‘Value at

Risk’ post has some important considerations for CTRM design for VaR in

general, such as ‘show your work’ and the ability to simultaneously run 95%

confidence level VaR and 99% confidence level VaR.

This section

covers some extra considerations for Historic VaR.

4.1) For each

‘price index’, CTRM systems should be able to let users decide which of three

above price change calculation approaches will be used.

4.2) Moveover, CTRM systems should allow for Historic VaR to be

run with two or more price approaches at the same time. For example, a firm might want to run VaR using

price changes based on subtracting two days (as shown in the above example) and

as a percentage change. Meaning, without having to change global system settings.

This generally

wouldn’t be needed for daily production use, but it can help during test

phases.

This is the

kind of thing that can be easy to apply to CTRM system design upfront, but,

with a bad design, can be hard to change later, i.e., after everything is

already built. So best

to get the design right upfront.

4.3) Holiday schedule handling. How

should the system handle days of missing prices. For example, suppose you have metal prices

from a London exchange, which would not post (i.e., provide prices) on a London

holiday, and crude oil prices from a New York exchange, which would not post

prices on a New York holiday, e.g., Fourth of July. The system needs to handle that

4.3.1) Correctly, meaning the numbers are as desired (and not

necessarily just one ‘correct’ way, i.e., correct is in the eye of the

beholder).

4.3.1.1) E.g.

first you need, for Historic VaR to be accurate, to line up all ‘trial MTMs’ by

the date. That could be the union of all

days that are a good business date for any one pricing source. Or maybe best to have a specific holiday

calendar, separately maintained, for which are considered the good business

days for the firm for calculating Historic VaR (i.e., rather than have the

system try to figure it out on its own based on when prices were published).

4.3.2) In a transparent way (i.e., ‘show your work’).

4.3.3) Giving

the user options, i.e., choices on how to handle the missing prices. An interpolation method. Example: If London publishes July 1, 2, 3, 4, and 5th

(five prices) and New York publishes July 1, 2, 3, and 5 (four prices, no price

on the holiday), the historic VaR framework would come up with an interpolated

price for July 4. This should be based

on however the user wants it work. E.g., average of the prices for the 3rd and 5th? Or ‘backstep’

interpolation, which is just to copy the prior day’s price, i.e., use the price from the 3rd as the New York price

for the 4th.

Introduction to

CTRM

Click on this

link for a great introduction to CTRM software: Introduction to CTRM Software