Intro

to Probability and Statistics

Sample

Final #3 – Questions Only

Professor Brian Shydlo

Instructions:

1) Please

write your name: _____________________________________

2) There

are 7 questions totaling 100 points. Please be careful to answer all questions.

Partial credit will be given.

Question 1)

16 Points

Question 2)

18 Points

Question

3) 6 Points

Question 4)

15 Points

Question 5)

18 Points

Question 6)

21 Points

Question

7) 6 Points

Total:

100 Points

Question

1) (15 points in total)

A certain

stock, X, has an expected return of 20%

per year and a standard deviation of 25%.

A certain

bond, Y, has an expected return of 5% per

year and a standard deviation of 9%.

The have a

correlation of -0.2.

You could

write this as:

mx

= 20, my

= 5, sx

= 25, sy

= 9, and rxy = -0.2.

Question

1a) (3 Points)

You decide

to invest $100 dollars in either X or Y or some combination of both. How do you allocate your $100 to maximize

your expected return?

Answer:

__________________________________________

Question

1b) (3 Points)

You

remember hearing something about diversification in an investments class. So you decide to split your money and invest

$50 in X and $50 in Y. How much money do

you expect to have after one year (your initial investment of $100 + the

expected return of your portfolio of X and Y).

Answer:

__________________________________________

Question

1c) (6 Points)

What is the

standard deviation and variance of the portfolio from part b?

Answer:

__________________________________________

Question

1d) (4 Points)

What is a

95% (2 standard deviation) confidence interval for

your return? That is, give me a

confidence interval for 50% in X and 50% in Y.

Answer:

__________________________________________

Question

2) (18 Points in total)

A city

decides to determine the mean expenditures per tourist per visit. A random sample of 100 finds that the average

expenditure is $800. The standard

deviation of expenditures for all tourists is $120.

Question

2a) (6 Points)

What is the

standard deviation of the mean, given that the standard deviation of the whole

population is $120 and the number of people sampled is 100?

Answer:

__________________________________________

Question

2b) (6 Points)

What is a

95% (2 standard deviation) confidence interval for the

value of the expenditures per tourist?

Base

this off the sample of 100 tourists. I

am not looking for the 2 standard deviation confidence interval of a single

sample from the population.

Answer:

__________________________________________

Question

2c) (6 Points)

If the city

wants the error of estimation to be $20, how many people does it need to

sample? (If this helps, remember that

the error of estimation is equal to half the width of the confidence interval.)

Answer:

__________________________________________

Question

3) (6 points in total)

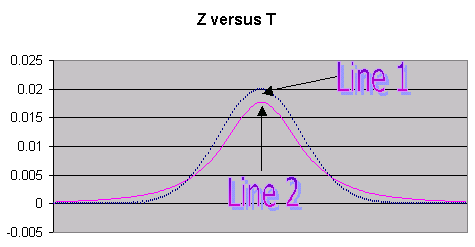

On the

following graph, one of the lines is the Z distribution and the other is the T

Distribution with 2 degrees of freedom.

Question

3a) (6 Points)

Is Line 1

the Z distribution or the T distribution with 2 degrees of freedom?

Answer:

__________________________________________

Question

4) (15 Points)

The average

distance of stopping a certain make of automobile is 65 feet. A company deigns a new brake thought to be

more effective than the type they currently use. To test this brake, they install it on 64

cars. The new brakes give a stopping

distance of 63 feet with a standard deviation of 4 feet.

Question

4a) (5 Points)

Formulate a

hypothesis for a lower-tail test. (i.e.

write the null hypothesis and the alternate hypothesis).

Answer:

__________________________________________

Question

4b) (5 Points)

Construct

the Z statistic to test how many standard deviations is the sample mean of 63 away

from the original mean of 65.

Answer:

__________________________________________

Question

4c) (5 Points)

Are the new

brakes significantly better than the old brakes? Significant is this case means 95%.

Answer:

__________________________________________

Question

5) (18 points) Someone

starts a new mutual fund that invests based on the winner of the Superbowl.

Quoted from

a newspaper from January 2001:

"One of the quirkiest stock market indicators is the so called Super Bowl predictor for the market. If the Super Bowl is won by a team from the original, pre-merger National Football League, the market will close higher by the end of the year. If a team from the old American Football League wins, then the market will fall."

Here is

data from the market over the last 10 years:

|

# |

Year |

Stock Market Return |

Old NFL Wins (Yes/No) |

Old NFL Wins (1/0) |

Prediction Correct |

|

1 |

1991 |

30 |

Yes |

1 |

Yes |

|

2 |

1992 |

-2 |

Yes |

1 |

No |

|

3 |

1993 |

20 |

Yes |

1 |

Yes |

|

4 |

1994 |

-2 |

No |

0 |

Yes |

|

5 |

1995 |

50 |

Yes |

1 |

Yes |

|

6 |

1996 |

40 |

Yes |

1 |

Yes |

|

7 |

1997 |

-20 |

Yes |

1 |

No |

|

8 |

1998 |

40 |

Yes |

1 |

Yes |

|

9 |

1999 |

60 |

Yes |

1 |

Yes |

|

10 |

2000 |

-5 |

No |

0 |

Yes |

If the old

NFL (National Football League)) wins the mutual fund puts their money into the

stock market, that is, they bet it will go up.

Otherwise if they bet it will go down.

If you look at the table above, you'll see that the prediction was

correct 8 out of 10 times or 80% of the time.

It was only wrong in 1992 and 1997.

You decide

to test out this theory by doing a simple linear regression. For the X (predictor variable) you use Old

NFL Wins (0 for no and 1 for yes). For the Y you use Stock Market Return. You run this through Minitab and this is the

output you get.

The regression equation is

Stock Return = - 3.5 + 30.7

Old NFL Wins?

Predictor Coef StDev T P

Constant -3.50 17.80 -0.20

0.849

NFL Wins 30.75

19.90 1.55

0.161

S = 25.17 R-Sq = 23.0% R-Sq(adj) = 13.4%

Analysis of Variance

Source DF SS MS F P

Regression 1

1512.9 1512.9 2.39

0.161

Residual Error 8

5068.0 633.5

Total 9 6580.9

Question 5a) (6 Points) Based on the Minitab output,

comment and interpret on whether or not it the regression model is valid in

this case.

Answer:

__________________________________________

Question

5b) (6 Points) This year, the Baltimore Ravens won, and they

are not part of the old NFL (they were part of the AFL), so the rule says that

the stock market should go down.

What is

your prediction of the return on the stock market based on the regression

equation from Minitab from part a?

(Regardless

of whether or not the regression is valid, I still want your prediction.)

Answer:

__________________________________________

Question

5c) (6 Points)

What is a 95% (2 standard deviation) confidence interval for your estimate from

part b?

Answer:

__________________________________________

Question

6) (21 points in total)

You are the

head of marketing for BSEOC Consulting. You are summoned to the CEO's office on

the other side of the building. He asks

to see the Minitab analysis of the regression of sales based on the amount of

advertising. He thinks he is extremely

proficient in statistics, and is capable of forming his own conclusions based

on the data, so he doesn't just want your interpretation of the Minitab output,

he wants to see it for himself.

You print

out the Minitab output and rush over to the CEO's office. It is a long walk and just as you reach the

office your clumsy coffee-drinking pal bumps into you, knocking you over and

causing your sheet of paper with the output to fall to the floor AND your

clumsy pal spills coffee on your Minitab output. It is too late to run back to

your desk to print out another copy. You

decide to hand write in the fields that are blurred by the coffee.

The regression equation is

Sales = 29.0 + 1.50 Advert

Predictor Coef StDev T P

Constant 28.959 6.637 XXXX1 0.002

Advert 1.4951 0.6355 XXXX2 0.046

S = XXXX3 R-Sq = XXXXX4 R-Sq(adj) = 33.5%

Analysis of Variance

Source DF SS MS F P

Regression 1

XXXXXX6

220.40 XXXX9 0.046

Residual Error X5 XXXXXX7 39.82

Total 9 XXXXXX8

Question

6a) (9 Points)

What is the

values of

1) The T-statistic for the constant?

Answer_______________________

2) The T-statistic for advertising?

Answer_______________________

3)

S, the Standard Error of the Regression?

Answer_______________________

4) R-Squared?

Answer_______________________

5) The Degrees of Freedom for the

Residual Error

Answer_______________________

6) SS-Regression (Sum of Squared of the

Regression)?

Answer_______________________

7) SS-Residual Error (Sum of Squared of

the Residual Error)?

Answer_______________________

8) SS-Total (Sum of Squared of the

Total)?

Answer_______________________

9) The F-statistic?

Answer_______________________

Question

6b) (6 Points)

You and the

CEO both agree that the linear regression model is appropriate for the data

originally used.

The CEO

decides to predict sales based on the advertising money spent.

You have 10

years worth of data as shown below. This

is the data that you used for the previous regression.

(All

Numbers in Millions)

|

Year |

Sales |

Advert |

|

1 |

32.2 |

3.2 |

|

2 |

33 |

5.4 |

|

3 |

41.8 |

12.1 |

|

4 |

38.2 |

9.6 |

|

5 |

45.8 |

12.8 |

|

6 |

44.5 |

12.6 |

|

7 |

46 |

13.3 |

|

8 |

49 |

9.6 |

|

9 |

52 |

11 |

|

10 |

56 |

10 |

The CEO

says,

"Well,

based on the regression equation of:

Sales = 29.0 + 1.50

Advertising

if our budget for Advertising is 100,

then we should be able to pull in sales of 29 + 1.50 * 100 which equals 179.

179 is great for us.

What do you tell your CEO with

regards to his prediction?

(What is the main warning you would

give the CEO why the prediction may not match the actual value?)

Answer:

__________________________________________

Question

6c) (6 Points)

You decide to try to improve the relatively small R-squared by (it is only

40.9%) by adding another predictor equation, in other words, you decide to

perform a multiple-linear regression.

You add in promotions and get the following output.

The regression equation is

Sales = 22.5 + 1.42 Advert +

2.06 Promotions

Predictor Coef StDev T P

Constant 22.489 7.602 2.96

0.021

Advert 1.4187 0.5960 2.38

0.049

Promotion 2.062 1.401 1.47

0.185

S = 5.896 R-Sq = 54.9% R-Sq(adj) = 42.0%

Analysis of Variance

Source DF SS MS F P

Regression 2

295.65 147.82 4.25

0.062

Residual Error 7

243.34 34.76

Total 9 538.98

Is it

appropriate to add promotions to the regression model? Answer "Yes" or "No" and

give a reason.

Answer:

__________________________________________

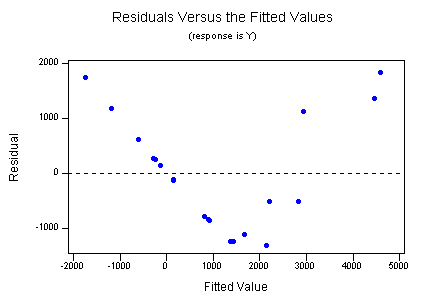

Question

7) (6 Points)

You run a simple linear regression on tree width versus age. Minitab produces

the following graph for you of the residuals.

What does

this graph tell you concerning the validity of the Linear Regression Model in

this case.

Answer:

__________________________________________