Intro

to Probability and Statistics

Sample

Final #1 – Questions Only

Professor Brian Shydlo

Instructions:

1) Please

write your name: _____________________________________

2) There

are 10 questions totaling 100 points. Please be careful to answer all

questions. Partial credit will be given.

Also, there are two questions for extra credit (one point each). There is no partial credit on the Extra

Credit questions.

Question 1)

8 Points (Correlation and Covariance)

Question 2)

15 Points (Expected Value and Standard

Deviation of a Portfolio of Two Assets)

Question 3)

6 Points (Basic Probability and Binomial Distribution)

Question 4)

10 Points (Linear Regression, theoretical concepts)

Question 5)

23 Points (Linear Regression)

Question 6)

9 Points (Multiple Linear Regression)

Question 7)

8 Points (Testing Two Sample Means)

Question 8)

6 Points (Hypothesis Testing)

Question 9)

5 Points (ANOVA Comparison Of Means)

Question

10) 10 Points (Sample Means and Confidence Intervals)

Total

100 Points

Question

1) (8 points in Total)

You have

the following table of X and Y values.

(For example, there is a 10% chance that X will be 4 and Y will be 2,

and so on…)

|

X |

Y |

Probability(X,Y) |

|

4 |

2 |

10% |

|

6 |

4 |

20% |

|

7 |

7 |

20% |

|

10 |

14 |

20% |

|

12 |

15 |

30% |

To help you

out I have calculated the Standard Deviation and Mean (or Expected Value) of

each.

μx = 8.6

μy = 9.7

sx

= 2.8

sy

= 5.1

Question

1a) (5 Points)

What is

Covariance(X,Y)?

Answer: ___________________________

Question

1b) (3 Points)

What is the

Correlation Coefficient of X,Y?

Answer: ___________________________

Question

2) (15 points in total)

A certain

stock, X, has an expected return of 15% per year and a standard deviation of

25%. The Stock is Normally Distributed.

A certain bond,

Y, has an expected return of 5% per year and a standard deviation of 9%. The Bond is Normally Distributed.

They have a

correlation of -0.2.

You could

write this as:

mx

= 15%, my

= 5%, sx

= 25%, sy

= 9%, and rxy = -0.2.

Question

2a) (3 Points)

You decide

to invest $100 dollars in either X or Y or some combination of both. How do you allocate your $100 to maximize

your expected return?

Answer: ___________________________

Question

2b) (3 Points)

You decide

to split your money and invest $50 in X and $50 in Y. How much money do you expect to have after

one year (your initial investment of $100 + the expected return of your

portfolio of X and Y). (The correct

answer is some number over $100… I am not asking how much more money you would

have.)

Answer: ___________________________

Question

2c) (5 Points)

What is the

standard deviation and variance of the portfolio from part b?

Answer: ___________________________

Question

2d) (4 Points)

What is a

95% (1.96 standard deviation) confidence interval for

your return? That is, give me a

confidence interval for 50% in X and 50% in Y.

Answer: ___________________________

Question

3 (6 points in Total)

Question

3a) (3 Points)

You have a

deck of card with 52 cards. It is a

standard bridge deck, which means it has 4 suits (hearts, clubs, spades and diamonds). For each suit you have 13 cards: Numbered

cards from 2 to 10, a Jack, Queen, King and an Ace.

Question

(3a): You pick 20 out of the 52 cards at random. What are the odds you'll see the Ace of

Spades?

Answer:

_____________________________________________

Question

3b) (3 Points)

With the

deck above you number each card from 1 to 52 so that

the Ace of Spades gets a Number of 1 and so on down to the lowest card, which

gets a number of 52. Furthermore, you

designate 26 (50%) of the cards to be in the top half and 26 to be in the

bottom half.

You observe

that for the 20 cards you picked out (one or a few at a time from the desk), 5

of them are in the top half and 15 of them are from the bottom half (in terms

of the ranking). Assuming that everything

is totally random, you decide to calculate the odds of getting 5 OR FEWER cards

in the top half when you draw 20 cards randomly from the deck as described

above.

You decide

to model this as a Binomial Distribution with a p, probability of success at

50% (since half of the cards are in the top half and half in the bottom

half). The formula you come up with is:

Sum from x

= 0 to 5 this: ![]()

Where p =

.5 and n = 20

Using this

formula (six times and taking the sum), you get a probability of 2.07% or about

1 in 50.

Question

(3b): Was your analysis/modeling of the problem above correct? If not, what is the problem with it?

Answer:

_____________________________________________

Question

4) (10 points in Total)

Question

4a) (5 Points)

You have

this data (exactly two datapoints)

|

X |

Y |

|

1 |

2 |

|

4 |

6 |

You decide

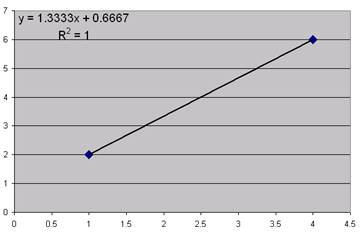

to run a regression and you get an R-squared of 100%. Here is a chart:

Question

(4a): Why is it a bad idea to do a regression and especially make predictions

and especially create confidence intervals around those predictions when you

only have two datapoints?

Answer:

_____________________________________________

Question

4b) (5 Points)

The Random

Walk theory of the Stock Market says that you can't predict what will happen

with the stock market. You tried to disprove

this, but so far no success.

One of the

models you used was to take the log of monthly returns for the S&P 500 from

Jan 1990 to April 2003 and then shift it by one month. You ran a regression of the shifted returns

(as the X) versus the unshifted returns (as the Y)

and found there was no relation. The

R-squared was zero.

You decide

it is pointless to try to predict future market direction based on historic

data, so you decide to try to predict market volatility based on historic

volatility. You set up a model where

you calculate volatility using the previous 12 months. So you calculate the February 1991 volatility

of the stock market as the standard deviation of the log of the stock market

returns from February 1990 to January 1991 (12 Months). You calculate the March 1991 volatility of

the stock market as the standard deviation of the log of the stock market

returns from March 1990 to February 1991 (12 Months). And so on.

As before

you decide to shift the volatility by one month and try to predict the next

month's volatility based on the previous months.

This is an

excerpt of the Raw Data:

|

Month |

Montly_Volatility (Y) |

Montly_Volatility_Previous_Month's (X) |

|

Feb-91 |

4.986% |

5.294% |

|

Mar-91 |

5.294% |

5.289% |

|

Apr-91 |

5.289% |

5.179% |

|

May-91 |

5.179% |

4.675% |

|

Jun-91 |

4.675% |

4.931% |

|

Jul-91 |

4.931% |

5.059% |

|

ect… |

ect… |

ect… |

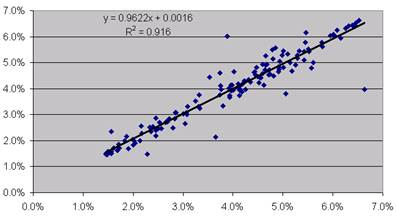

Here is

graph of the Data:

Here is the

Minitab output of the Data:

The regression equation is

Montly_Volatility = 0.00183 + 0.952

Montly_Volatility_t-1

Predictor Coef StDev T P

Constant 0.001825

0.001016 1.80

0.074

Montly_V 0.95201 0.02410 39.50

0.000

S = 0.004233 R-Sq = 91.6%

Analysis of Variance

Source DF SS MS F P

Regression 1

0.027958 0.027958 1560.14

0.000

Residual Error 143

0.002563 0.000018

Total 144 0.030520

Question

(4b): At first you are thrilled with the 91.6% R-squared. Then you realize that a

R-squared that high is to be expected… meaning that the result is trivial.

In other words,

everything about your regression was totally accurate from a technical point of

view… low p-score, linear relationship, ect…, but the

high R-squared is a trivial result.

Why?

Answer:

_____________________________________________

Question

5 (23 points in Total)

You do a

regression of X against Y. You get these

results:

Regression Analysis

The regression equation is

Y = 12.2 + 0.533 X

Predictor Coef StDev T

P

Constant 12.176 4.002 3.04

0.005

X 0.5334 0.1372 AAAA

0.001

S = 10.65 R-Sq =

BBBB

Analysis of Variance

Source DF SS MS F P

Regression 1 DDDD CCCC

15.11 0.001

Residual Error EEEE

3288.7 113.4

Total 30 5002.2

Question

5a) (3 Points)

Predict Y

when X = 20

Answer:

_____________________________________________

Question

5b) (3 Points)

Create a

95% Confidence Interval for your prediction.

Assume that 2.04 is the correct number for the t-distribution such that

95% of the data is between -2.04 +2.04 for the appropriate number of degrees of

freedom (in other words, use 2.04 when building your confidence interval).

Answer:

_____________________________________________

Question

5c) (5 Points)

List 3

possible reasons why your confidence interval may be off or inappropriate.

Answer:

_____________________________________________

Question

5d) (5 Points)

Fill in the

missing values from the Regression Output Table (1 point each).

AAAA:

_____________________________________________

BBBB:

_____________________________________________

CCCC:

_____________________________________________

DDDD:

_____________________________________________

EEEE:

_____________________________________________

Question

5e) (4 Points)

You do

another (unrelated) regression of a new X against a new Y. You have 10 datapoints. You get an R-squared of 80%, an F-score of 32

and a Standard Error of the Regression of 4.68188.

What is the

Standard Deviation of the variable Y?

Hint:

Make an ANOVA table based on the above information.

Answer:

_____________________________________________

Question

5f) (3 Points)

Your friend

does another (unrelated) regression of a new X against a new Y. Your friend get a

low p-score of .00001 and an R-squared of 4.6%.

Everything else with the regression checks out as being valid.

Your friend

decides to not use the Linear Regression model since it has such a low

R-squared. What do you tell your

friend about your friend's decision to reject the Linear Regression model due

to the low R-squared?

Answer:

_____________________________________________

Question

6 (9 points in Total)

You get

some data regarding a batter. This is

it:

|

Hits |

Misses |

Total at Bats |

|

6 |

14 |

20 |

|

7 |

14 |

21 |

|

8 |

15 |

23 |

|

7 |

17 |

24 |

|

8 |

13 |

21 |

|

7 |

16 |

23 |

|

6 |

18 |

24 |

|

7 |

15 |

22 |

|

6 |

17 |

23 |

|

7 |

17 |

24 |

You decide

to run a Multiple Linear Regression to use Hits and Misses to predict Total at

Bats.

Question

6a) (4 Points)

What is the

Regression Equation (2 points of credit) and R-squared (2 points of credit)?

Answer:

_____________________________________________

Question

6b) (5 Points)

You do

another (totally unrelated) Multiple Linear Regression. You have two variables, X1 and X2, which you

use to predict a third variable called Y.

This is the

output from Minitab:

Regression Analysis

The regression equation is

Y = 10.2 + 0.0605 X1 + 0.757

X2

Predictor Coef StDev T P

Constant 10.166 2.147

4.74 0.002

X1 0.06050 0.05639 1.07

0.319

X2 0.7569 0.1380 5.48

0.001

S = 0.6742 R-Sq =

82.8% R-Sq(adj) = 77.9%

Analysis of Variance

Source DF SS MS

F P

Regression 2

15.3183 7.6591 16.85

0.002

Residual Error 7

3.1817 0.4545

Total 9 18.5000

Question (6b): Comment on the table

above, specifically commenting on the appropriateness of the Multiple Linear

Regression Model based solely on the above table of data. If the model is not appropriate in this

case, what might you do to make it better?

Answer:

_____________________________________________

Question

7 (8 points in Total)

Question

7a) (5 Points)

An

interesting article was published recently that talked about why many of us are

feeling that things are getting more expensive even though the Consumer Price

Index is only 3%.

The article

describes the CPI (Consumer Price Index) as a basket of commonly purchased

items (e.g., Computer, TV, Mortgage, Clothing, furniture, cars, ect...). It goes on

to say how items relating to the maintenance of purchases (and one's self) are

not included in the CPI (e.g., Health Care, Cable TV, Gasoline, Tuition, Car

Insurance, Home Heating Oil, Train Fare, ect…) are

going up at a higher rate.

Below is

data meant to illustrate the kind of data from the article:

|

|

Consumer Price

Index |

Cost of Maintaining

Items |

|

Item 1 |

1.60% |

4.30% |

|

Item 2 |

2.40% |

4.60% |

|

Item 3 |

4% |

5.20% |

|

Item 4 |

2.80% |

6.90% |

|

Item 5 |

3.00% |

7.30% |

|

Item 6 |

1.00% |

8.90% |

|

Item 7 |

-4% |

|

|

Item 8 |

10% |

|

|

Item 9 |

6% |

|

You realize

that the average of the Non-CPI items is higher, yet you also realize that

there is a chance that all of these items may come from the same

population. You decide to run a T-test

for comparing two sample means. Here is

what you get:

|

t-Test:

Two-Sample Assuming Unequal Variances |

|

|

|

|

Consumer Price

Index |

Cost of Maintaining

Items |

|

Mean |

2.98% |

6.2% |

|

Variance |

0.001429444 |

0.0003232 |

|

Observations |

9 |

6 |

|

Hypothesized

Mean Difference |

0 |

|

|

df |

12 |

|

|

t

Stat |

-2.209418802 |

|

|

P(T<=t)

one-tail |

0.023664899 |

|

It is true

that the means are not equal? Please

formally state your conclusion and give reasons why.

Answer:

_____________________________________________

Question

7b) (3 Points)

Assuming

Unequal Variances is the more conservative approach: True or False?

Answer:

_____________________________________________

Question

8 (6 points in Total)

Write the

null and alternate hypothesis for the following items. This can be an English description or using

symbols.

Question

8a) (3 Points)

The ANOVA

test for comparing means:

Answer:

_____________________________________________

Question

8b) (3 Points)

Multiple

Linear Regression:

Answer:

_____________________________________________

Question

9 (5 points in Total)

Imagine you

run a customer service desk for a product with 5 customers. You record the number of Service Requests

each month and have these averages for year-to-date 2003:

|

Customer A |

Customer B |

Customer C |

Customer D |

Customer E |

|

14 |

9.4 |

8.8 |

16.2 |

10.6 |

The raw

data is:

|

|

Customer A |

Customer B |

Customer C |

Customer D |

Customer E |

|

Jan |

13 |

16 |

7 |

27 |

13 |

|

Feb |

10 |

11 |

5 |

21 |

6 |

|

Mar |

20 |

9 |

7 |

23 |

16 |

|

April |

18 |

5 |

18 |

7 |

14 |

|

May |

9 |

6 |

7 |

3 |

4 |

You run an

ANOVA test to try to determine if the means could really be the same. You get these results:

Analysis of Variance

Source DF

SS MS F

P

Factor 4

202.0 50.5 1.21

0.338

Error 20

836.0 41.8

Total 24

1038.0

Individual

95% CIs For Mean

Based on

Pooled StDev

Level N

Mean StDev ------+---------+---------+---------+

Customer 5

14.000 4.848 (---------*---------)

Customer 5

9.400 4.393 (---------*---------)

Customer 5

8.800 5.215 (---------*---------)

Customer 5

16.200 10.545 (---------*---------)

Customer 5

10.600 5.273 (---------*---------)

------+---------+---------+---------+

Pooled StDev

= 6.465 6.0 12.0

18.0 24.0

What does

the test above say about the possibility that all the means are equal?

Answer:

_____________________________________________

Question

10 (10 points in Total)

You conduct

a sample of 64 items. Your sample mean is

20 and you get a sample standard deviation of 10.

Question

10a) (3 Points)

Write out

the formula you would have used to calculate the Sample Standard Deviation?

Answer:

_____________________________________________

Question

10b) (2 Points)

What is

your point estimate for the true population mean?

Answer:

_____________________________________________

Question

10c) (5 Points)

Write out a

95% Confidence Interval for the True Population Mean. Assume that +-1.96 standard deviations hold 95%

of the data.

Answer:

_____________________________________________

Extra

Credit 1 (1 Point)

The

Standard Normal Distribution has a mean of 0, a Variance and Std Dev of 1

The

T-Distribution has a mean of zero. Could it have a Standard Deviation of Sqrt(df / df+2)?

Sqrt = Square Root

df = Degrees of Freedom

Don't just

give a True/False, explain why.

Answer:

_____________________________________________

Extra

Credit 2 (1 Point)

Half of the

numbers (meaning area under the curve) in a Chi-Squared Distribution are above

the Expected Value of the distribution.

Don't just

give a True/False, give the reasons.

Answer:

_____________________________________________