Intro

to Probability and Statistics

Sample

Final #2 Questions And Answers (Answer Key)

Professor Brian Shydlo

Instructions:

1) Please

write your name: _____________________________________

2) There

are 7 questions totaling 100 points. Please be careful to answer all questions.

Partial credit will be given.

Question 1)

12 Points (Correlation and Covariance)

Question

2) 8 Points (Expected Value and Standard Deviation of a

Portfolio of Two Assets)

Question 3)

15 Points (Sample Means and Confidence Intervals)

Question 4)

15 Points (T Distribution)

Question 5)

29 Points (Linear Regression)

Question 6)

12 Points (Multiple Linear Regression)

Question

7) 9 Points (Miscellaneous)

Total 100

Points

Question

1) (12 points in Total)

You have

the following table of X and Y values.

(For example, there is a 40% chance that X will be 8 and Y will be 11,

and so on

)

|

X |

Y |

Prob(y,x) |

|

2 |

3 |

20% |

|

3 |

5 |

20% |

|

4 |

10 |

20% |

|

8 |

11 |

40% |

To help you

out I have calculated the Variance and Mean (or Expected Value) of each.

μx

= 5

μy

= 8

sx2

= 6.4

sy2

= 11.2

Question

1a) (6 Points)

What is

Covariance(X,Y)?

Answer: _______ญญญญญญญญญญญญญ____________________

Answer 1a)

Covariance = 7.4

|

X |

Y |

Prob(y,x) |

X- μx |

Y - μy |

Prob(y,x) * (X- μx)

* (Y - μy) |

|

2 |

3 |

20% |

-3 |

-5 |

3 |

|

3 |

5 |

20% |

-2 |

-3 |

1.2 |

|

4 |

10 |

20% |

-1 |

2 |

-0.4 |

|

8 |

11 |

40% |

3 |

3 |

3.6 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Sum = 7.4 |

Question

1b) (4 Points)

What is the

Correlation Coefficient of X,Y?

Answer: _______ญญญญญญญญญญญญญ____________________

Answer 1b)

Correlation(X,Y)

= Covariance(X,Y) / (sx * sy)

The

Variances were given, so you need to figure out the Standard Deviations:

sx = √sx2 = √6.4 = 2.530

sy = √sy2 = √11.2 = 3.347

so

Correlation(X,Y) = 7.4 / (2.530 * 3.347)

= 0.874

Question

1c) (2 Points)

Suppose you

got to part B an answer of a Correlation Coefficient of 1.2. What would you conclude about your answer?

Answer: _______ญญญญญญญญญญญญญ__________________________________________

Answer 1b)

You

would conclude you made a mathematical error.

Correlation Coefficients must be between -1 and 1.

Question

2) (8 Points in Total)

A certain

stock, X, has an expected return of 40% per year and a standard deviation of

50%.

A certain

bond, Y, has an expected return of 10% per year and a standard deviation of 10%.

The have a

Correlation Coefficient of 0.6

You could

write this as:

mx

= 40%, my

= 10%, sx

= 50%, sy

= 10%, and рx,y

= 0.6

Question

2a) (3 Points)

You decide

to invest $40 dollars in X and $60 in Y ($100 in total).

How much

money do you expect to have in one year?

Answer: _______ญญญญญญญญญญญญญ____________________

Answer 2)

$40 * (1 + 0.40) + $60 * (1 + 0.10) = 122

Question

2b) (5 Points)

You decide

to invest $40 dollars in X and $60 in Y ($100 in total).

What is the

Standard Deviation your portfolio?

Answer: _______ญญญญญญญญญญญญญ____________________

Answer 2b)

Variance(whole portfolio) = (Psx)2 + ((1-P)sy)2 + 2 * (Psx) * ((1-P)sy)) * rxy

Variance(whole portfolio) = (0.4 * 0.40)2 + (0.6 * 0.10)2 + 2 * (0.4 * 0.50) * (0.6 * 0.10)) * 0.6

Variance(whole portfolio) = (0.16)2 +

(0.06)2 + 2 * (0.2) * (0.06)

* 0.6

Variance(whole portfolio) = 0.0256 + 0.0036 +

0.024

Variance(whole portfolio) = 0.0532%2

Standard Deviation of Whole Portfolio = sqrt(154)

= 0.231 or 23.1%

Question

3) (15 Points in Total)

A random

sampling of 100 American shrubs revealed the average height of a shrubbery to

be 60 centimeters. The Standard

Deviation of shrubberies is well known to be 15 centimeters (meaning that the

Standard Deviation of the population of shrubberies is known with certainty to

be 15 centimeters).

Question

3a) (5 Points)

What is the

Standard Error (also called the Standard Deviation) of the Sample Mean?

Answer: _______ญญญญญญญญญญญญญ____________________

Answer 2a)

s x = 15

s x-bar = 15 / Sqrt(100) = 15 / 10 = 1.5

s x-bar = 1.5

Question

3b) (5 Points)

What is a

95% (2 standard deviation) Confidence Interval for the height of an American

shrub? Please assume that the

appropriate Z-score to use is 1.96.

Answer: _______ญญญญญญญญญญญญญ____________________

Answer 3b)

P[60

- (1.96*1.5)

< μ < 60 + (1.96*1.5) ]

= 95%

P[60

- 2.94<

μ < 60

+ 2.94] = 95%

P[57.06 < μ < 62.94] = 95%

Question

3c) (5 Points)

What would

the sample size need to be to get a 95% Confidence Interval that is exactly 9.8

centimeters wide? (Please use a Z-score of exactly 1.96)

Answer 3c)

n

= (1.962 x 152) / 4.92 = 36 shrubs

Question

4) (15 points in Total)

I took a

sample and created 2 Confidence Intervals each with the same Standard Deviation

and Point Estimate of the mean of a distribution. Both Confidence Intervals were for 95%.

The only

thing that was different between the two Confidence Intervals was that for one

of them I used the Z-distribution (Standard Normal) and for the other one I

used the T-distribution:

Confidence

Interval A: P[68.24 ≤ μ

≤ 91.76] = 95%

Confidence

Interval B: P[60.91 ≤ μ

≤ 99.10] = 95%

Question

4a) (4 Points)

For which

Confidence Interval did I use the T distribution (A or B)?

Answer: __________________

Answer 4a)

Confidence

Interval B is wider, so it must use the T distribution.

Question

4b) (4 Points)

For the

distribution that used the Z distribution I used a Z score of exactly 1.96

(meaning Zα/2 is 1.96). What was the Standard Deviation I

used?

Answer: __________________

Answer 4b)

This

is the Confidence Interval as written:

P[68.24

≤ μ ≤

91.76] = 95%

Here

is the formula:

P[μ

- (Zα/2 * s) ≤ μ

≤ μ + (Zα/2 *

s)] = 95%

Which

becomes:

P[μ

- (1.96 * s) ≤ μ

≤ μ + (1.96 *

s)] = 95%

91.76 - 68.24 = 23.52

so

μ

+ (1.96 * s) - [μ - (1.96 * s)] = 23.52

μ

+ (1.96 * s) - μ + (1.96 * s) = 23.52

(1.96

* s) + (1.96 * s) = 23.52

2

* (1.96 * s) = 23.52

3.92s = 23.52 so s = 6

FYI

.

The Sample Mean I used was 80, which is at the midpoint of the Confidence

Interval.

(If

you mistakenly put Confidence Interval A for the answer to question 3a, you

would have got that wrong, but this one correct if you put 9.74 as the answer).

Question

4c) (4 Points)

I didnt

say how many degrees of freedom I used for calculating the T distribution, but

given the following choices, which one do you think I used?

Choice A: 3 Degrees of Freedom

Choice B: 103 Degrees of Freedom

Answer: __________________

Answer 4c)

The

answer is Choice A.

For

Degrees of Freedom of 3, the T-score is 3.18, which is what I used for the

Confidence Interval as written:

For

Degrees of Freedom of 103, the T-score is 1.98, which is very close to the 1.96

that I would have got had I used the Standard Normal Distribution

(Z-score).

This

question was designed to test whether you knew that the T-score becomes equal

to the Z-score as N gets large. If the

Degrees of Freedom where 103, then the 2 Confidence Intervals would have been

almost identical.

Question

4d) (3 Points)

If I had

used the Degrees of Freedom of 103, then what must n have been (or how many items were in the sample or what

was the sample size)?

Answer: __________________

Answer 4d)

The

answer is 104 in the sample.

The

formula for Degrees of Freedom for the T distribution is:

df

= n -1

df

+ 1 = n

so

103

+ 1 = 104

Question

5) (29 Points in Total)

I did a

regression on the following data:

|

# |

X |

Y |

|

1 |

2.060 |

2.044 |

|

2 |

0.064 |

0.059 |

|

3 |

1.202 |

1.124 |

|

4 |

0.800 |

0.500 |

|

5 |

4.099 |

5.080 |

|

6 |

3.516 |

3.500 |

|

7 |

2.157 |

2.362 |

|

8 |

1.378 |

1.410 |

|

9 |

3.481 |

4.084 |

|

10 |

0.301 |

0.319 |

and got the

following information:

The regression equation is

Y = - 0.227 + 1.19 X

Predictor Coef StDev T P

Constant -0.2268 0.1494 -1.52

0.167

X 1.19374 0.06413 18.62

0.000

S = 0.272 R-Sq = XXxXXX

Analysis of Variance

Source DF SS MS F P

Regression 1

25.558 25.558 XXXxXX

0.000

Residual Error XX

0.590 0.074

Total XX 26.148

Unfortunately,

the printer is an old model and it smudged the output. I would print another copy, but I realized

that it was the last piece of paper. Please help me reassemble the original output

Question

5a) (3 Points)

What is the

Degrees of Freedom Total?

Answer: __________________

Answer 5a)

The

Degrees of Freedom Total = n - 1 = 10 - 1 = 9

Question

5b) (3 Points)

What is the

R-Squared?

Answer: __________________

Answer 5b)

R-Squared

= SSR/SST = 25.558/26.148

= 97.7%

Question

5c) (3 Points)

What is the

F-score?

Answer: __________________

Answer 5c)

F-Score

= MSR/MSE = 25.558/0.074 = 345.38

Question

5d) (4 Points)

Please predict

Y using the Regression Equation when X = 3.

Answer: __________________

Answer 5d)

Y

= - 0.227 + 1.19 X

Y

= - 0.227 + 1.19 * 3

Y

= - 0.227 + 3.57 = 3.343

Question

5e) (4 Points)

Please give

me a 95% Confidence Interval for Y when X = 3.

Please use a Z-score of 1.96 for your Confidence Interval.

Answer: __________________

Answer 5e)

The

Point Estimate of Y was calculated in part A to be 3.343.

The

Standard Error of the regression is: 0.272.

P

[3.343 - (Zα/2 * s) < μ < 3.343 + (Zα/2

* s)] = 95%

P

[3.343 - (1.96 * 0.272) < μ < 3.343 + (1.96 * 0.272)] = 95%

P

[3.343 - (0.533) < μ < 3.343 + (0.533)] = 95%

P [2.810 < μ < 3.876)] = 95%

Question

5f) (4 Points)

How might

you respond to someone who asked you to predict a Y with an X of 30?

Answer:

___________________________________________

Answer 5f)

This

would not be valid as you would be extrapolating.

Question

5g) (3 Points)

You do

another, unrelated regression and get the following information:

R-Squared =

81%

The

regression equation is

Y = 10.1 -

0.879 X

What is the

value of R (the correlation coefficient?)

Answer: __________________

Answer 5g)

ρ

= √(R2) = √0.81 = .90

You

need to set the sign to negative since the slope of the Regression Equation is

negative, so the answer is -0.90

Question

5h) (5 Points)

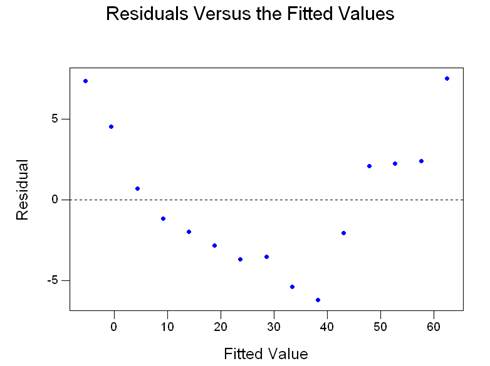

I did

another, unrelated regression and got the chart below. Is there anything about this chart, which

shows the errors (also called the residuals), which would make you question the

validity of this Regression?

Answer:

___________________________________________

Answer 5h)

The

errors seem to follow a pattern. An

assumption of the model is that the errors are random, hence this picture

suggests a violation of one of the assumptions of the Linear Regression Model.

Question

6) (12 points in Total)

The

following is output from a Multiple Linear Regression:

The regression equation is

Y = - 13.4 + 4.78 X + 0.674

Z

Predictor Coef StDev T P

Constant -13.376 3.867 -3.46

0.005

X 4.7839 0.2727 17.54

0.000

Z 0.6738 0.6479 XXXX

0.319

S = 4.451 R-Sq = 96.5%

Analysis of Variance

Source DF SS MS F P

Regression 2

6598.0 3299.0 166.54

0.000

Residual Error 12

237.7 19.8

Total 14 6835.7

Question

6a) (4 Points)

Please

predict Y when X = 5 and Z = 6

Answer: __________________

Answer 6a)

Use

the Multiple Regression Equation:

Y

= - 13.4 + 4.78 * 5 + 0.674 * 6

Y

= - 13.4 + 23.9 + 4.044 = 14.544

Question

6b) (5 Points)

Please

comment on the value of adding the Z variable to the Regression Model (versus

leaving it out).

Answer:

________________________________________

Answer 6b)

Since

the p-value Z is so high (it is 0.319, which is above 0.05) this suggests that

the Regression should be run again without including Z. I did and got an R-Squared of 96.2%, which is

very close to the R-squared I got using 2 variables.

Question

6c) (3 Points)

What is the

T-score of the variable "Z".

(In the regression output, it is the value with the XXXX in it.)

Answer: __________________

Answer 6c)

The

T-score = (Coefficient - 0) / Standard Deviation =

(

0.6738 - 0 ) / 0.6479 = 1.04

Question

7) (9 points in Total)

Question

7a) (3 Points)

It is

possible to have Covariance(X,Y) = 200 and Correlation Coefficient(X,Y) = -0.6

Please

indicate if this is True or False

Answer: __________________

Answer 7a)

False. The sign of the Covariance and the

Correlation Coefficient must be the same.

Question

7b) (3 Points)

You do 2

simple Linear Regressions:

Y = 0 + 3X

Y = 0 + 5Z

If you do a

Multiple Linear Regression you would expect to see this as your Regression

Equation: Y = 0 + 3X + 5Z

Please

indicate if this is True or False

Answer: __________________

Answer 7b)

False. In general, the slopes of a Multiple Linear

Regression of X,Y,Z would be expected to be different compared to a simple

Linear Regression of X,Y and Z,Y.

Question

7c) (3 Points)

You run a Multiple

Linear Regression of three variables (e.g., A, B, C) and then add a forth

variable (e.g., D) it is possible for your new R-Squared to be higher, even if

there is actually no "true" relationship between D and any other

variables.

Please

indicate if this is True or False

Answer: __________________

Answer 7c)

True. You would expect for the R-squared to

increase since random chance would tend to show at least a small correlation

between two (or more) variables even if the long run value of the correlation

where zero.